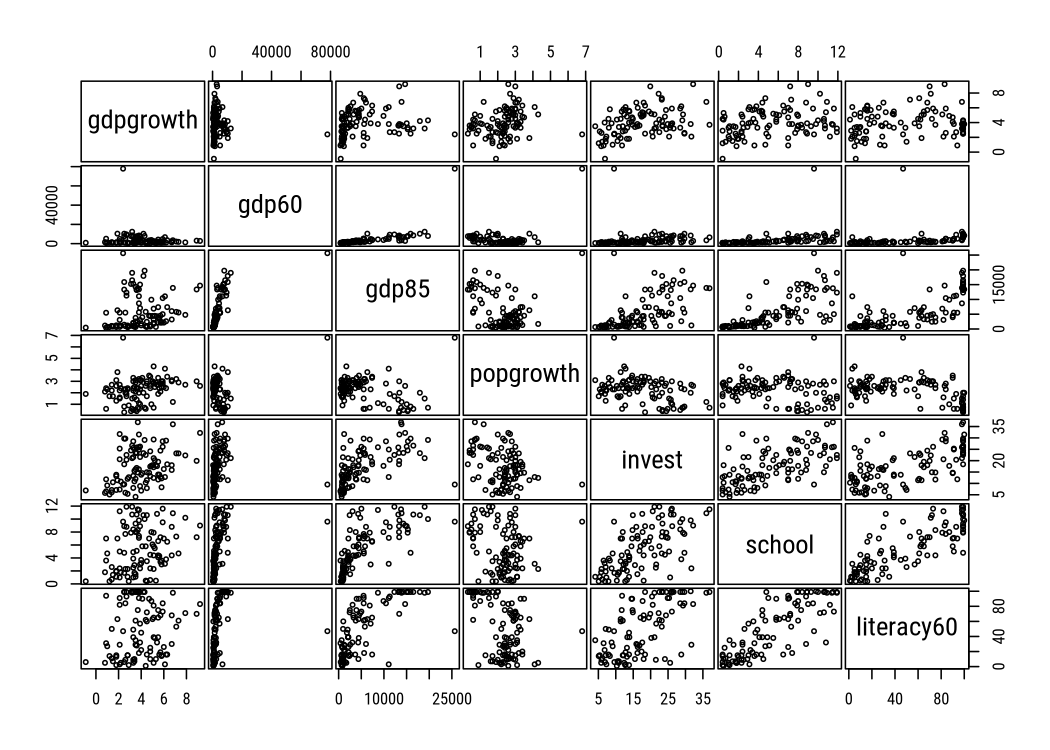

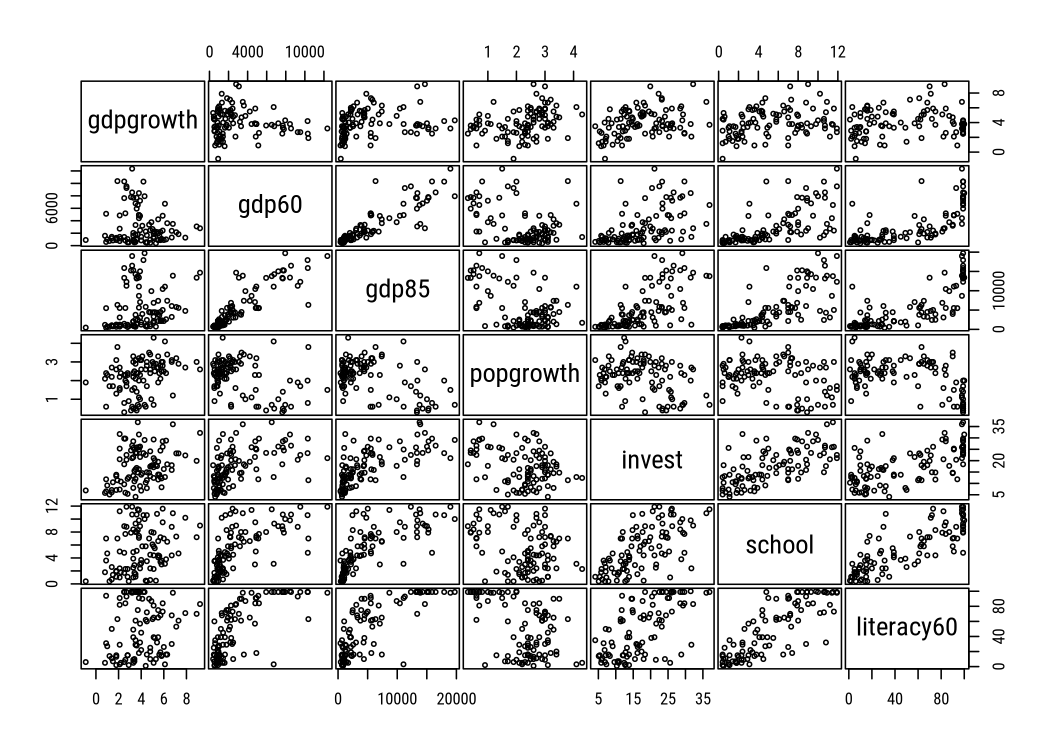

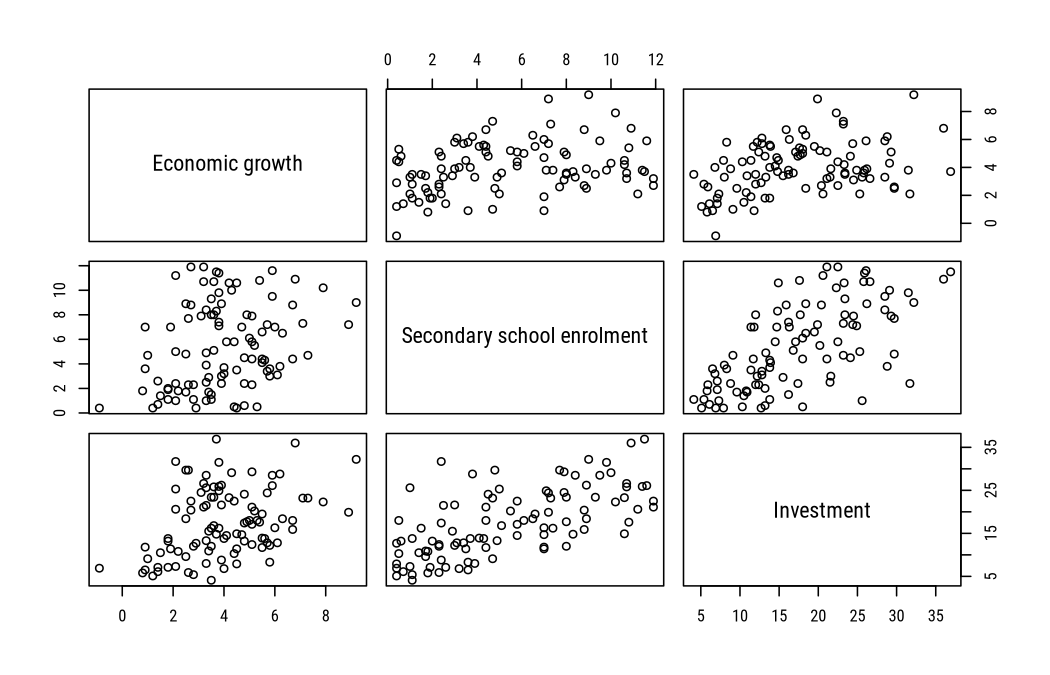

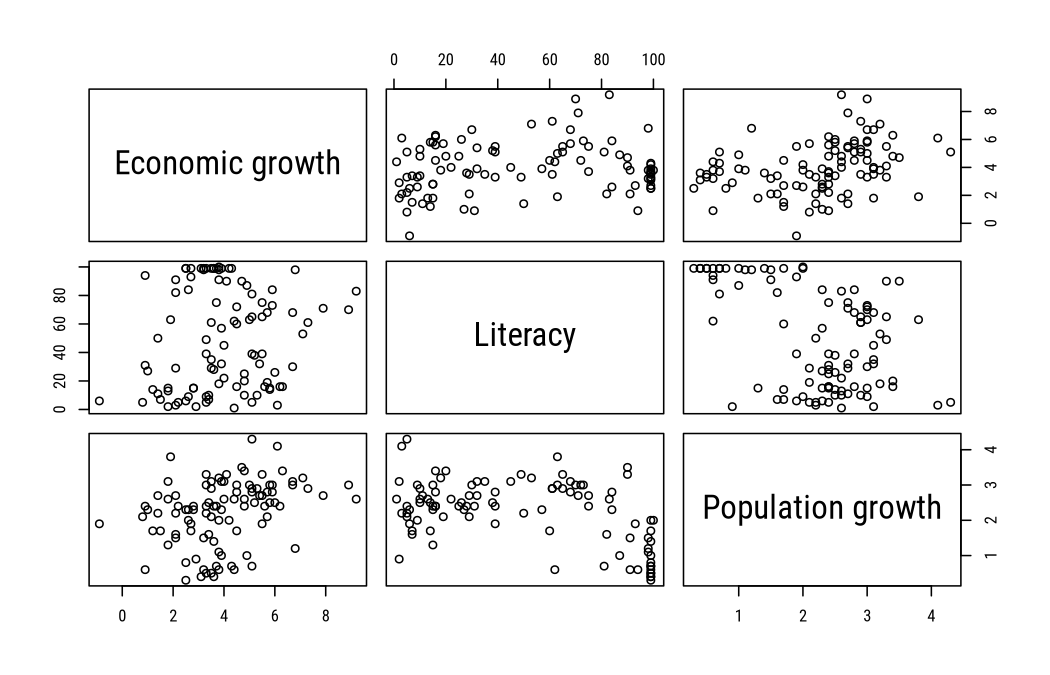

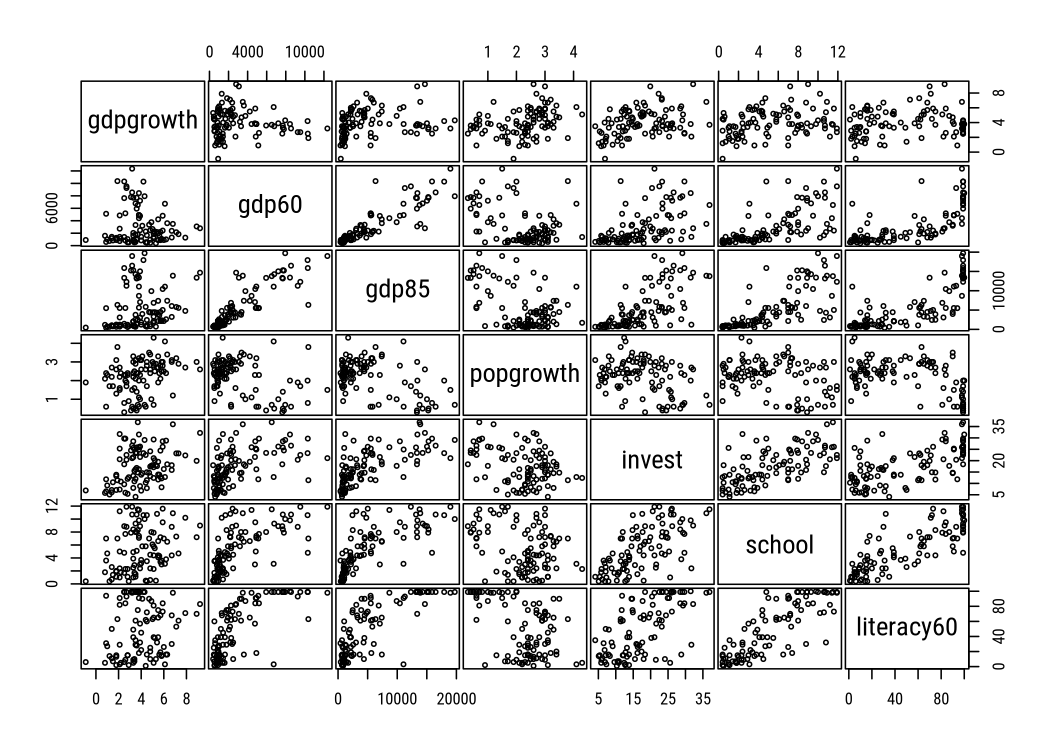

class: center, middle, inverse, title-slide # Multiple linear regression ## Research methods ### Jüri Lillemets ### 2021-12-07 --- class: center middle clean # How to model a relationship with multiple predictors? --- class: center middle inverse # Least squares with multiple predictors --- ## What does a multiple linear regression model look like? A model with two predictors can be expressed as follows: `$$y = \beta_0 + \beta_{1} x_1 + \beta_{2} x_2 + \varepsilon$$` where - `\(\beta_1\)` is a coefficient of `\(x_1\)` and - `\(\beta_2\)` is a coefficient of `\(x_2\)`. --- Let's illustrate it with data on "Determinants of Economic Growth". .small[ - `oil` factor. Is the country an oil-producing country? - `inter` factor. Does the country have better quality data? - `oecd` factor. Is the country a member of the OECD? - `gdp60` Per capita GDP in 1960. - `gdp85` Per capita GDP in 1985. - `gdpgrowth` Average growth rate of per capita GDP from 1960 to 1985 (in percent). - `popgrowth` Average growth rate of working-age population 1960 to 1985 (in percent). - `invest` Average ratio of investment (including Government Investment) to GDP from 1960 to 1985 (in percent). - `school` Average fraction of working-age population enrolled in secondary school from 1960 to 1985 (in percent). - `literacy60` Fraction of the population over 15 years old that is able to read and write in 1960 (in percent). ] -- Suppose that we wish to know how do population growth and investments influence economic growth. --- What does the data look like? Here are first rows: .compact[ | |oil |inter |oecd | gdp60| gdp85| gdpgrowth| popgrowth| invest| school| literacy60| |:--|:-----|:-----|:-----|-----:|-----:|---------:|---------:|------:|------:|----------:| |1 |FALSE |TRUE |FALSE | 2485| 4371| 4.8| 2.6| 24.1| 4.5| 10| |2 |FALSE |FALSE |FALSE | 1588| 1171| 0.8| 2.1| 5.8| 1.8| 5| |3 |FALSE |FALSE |FALSE | 1116| 1071| 2.2| 2.4| 10.8| 1.8| 5| |5 |FALSE |FALSE |FALSE | 529| 857| 2.9| 0.9| 12.7| 0.4| 2| |6 |FALSE |FALSE |FALSE | 755| 663| 1.2| 1.7| 5.1| 0.4| 14| |7 |FALSE |TRUE |FALSE | 889| 2190| 5.7| 2.1| 12.8| 3.4| 19| |8 |FALSE |FALSE |FALSE | 838| 789| 1.5| 1.7| 10.5| 1.4| 7| |9 |FALSE |FALSE |FALSE | 908| 462| -0.9| 1.9| 6.9| 0.4| 6| |10 |FALSE |FALSE |FALSE | 1009| 2624| 6.2| 2.4| 28.8| 3.8| 16| |11 |FALSE |FALSE |FALSE | 907| 2160| 6.0| 2.5| 16.3| 7.0| 26| |12 |FALSE |TRUE |FALSE | 533| 608| 2.8| 2.3| 5.4| 1.1| 15| |15 |FALSE |FALSE |FALSE | 1009| 727| 1.0| 2.3| 9.1| 4.7| 27| |17 |FALSE |TRUE |FALSE | 1386| 1704| 5.1| 4.3| 12.4| 2.3| 5| |18 |FALSE |TRUE |FALSE | 944| 1329| 4.8| 3.4| 17.4| 2.4| 20| |20 |FALSE |FALSE |FALSE | 863| 944| 3.3| 3.0| 21.5| 2.5| 9| |21 |FALSE |TRUE |FALSE | 1194| 975| 1.4| 2.2| 7.1| 2.6| 50| |22 |FALSE |TRUE |FALSE | 455| 823| 4.8| 2.4| 13.2| 0.6| 25| |23 |FALSE |TRUE |FALSE | 737| 710| 2.1| 2.2| 7.3| 1.0| 3| |24 |FALSE |FALSE |FALSE | 777| 1038| 3.3| 2.2| 25.6| 1.0| 5| |26 |FALSE |TRUE |FALSE | 1030| 2348| 5.8| 2.5| 8.3| 3.6| 14| ] --- Start with examining (plotting) relationships. <!-- --> ??? Can you see something wrong here? An outlier! --- Suppose we have a reason to exclude the outlier. <!-- --> --- For three variables we need three dimensions. <div id="htmlwidget-db7ea0aa20210941cbc4" style="width:100%;height:600px;" class="widgetframe html-widget"></div> <script type="application/json" data-for="htmlwidget-db7ea0aa20210941cbc4">{"x":{"url":"08_multiple_files/figure-html//widgets/widget_unnamed-chunk-5.html","options":{"xdomain":"*","allowfullscreen":false,"lazyload":false}},"evals":[],"jsHooks":[]}</script> --- Our model is thus `$$gdpgrowth = \beta_0 + \beta_{1} popgrowth + \beta_{2} invest + \varepsilon.$$` ``` ## ## Call: ## lm(formula = gdpgrowth ~ popgrowth + invest, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -4.1645 -0.6789 0.0356 0.9037 3.8189 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -0.50729 0.62435 -0.813 0.419 ## popgrowth 1.02477 0.17286 5.928 4.80e-08 *** ## invest 0.12634 0.02017 6.262 1.07e-08 *** ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.464 on 96 degrees of freedom ## Multiple R-squared: 0.365, Adjusted R-squared: 0.3517 ## F-statistic: 27.59 on 2 and 96 DF, p-value: 3.423e-10 ``` --- With two predictors, the model is now a plane not a line. <div id="htmlwidget-b51f383d4352a6ced9ae" style="width:100%;height:600px;" class="widgetframe html-widget"></div> <script type="application/json" data-for="htmlwidget-b51f383d4352a6ced9ae">{"x":{"url":"08_multiple_files/figure-html//widgets/widget_unnamed-chunk-7.html","options":{"xdomain":"*","allowfullscreen":false,"lazyload":false}},"evals":[],"jsHooks":[]}</script> ??? %>% More predictors, more dimensions. If one side is changed, the other also changes: coefficients are often interdependent. --- class: center middle inverse # Why use multiple predictors? --- ### Variables may have mutual influence .small[ .pull-left[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ school, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -4.1126 -1.2308 -0.2379 1.2776 4.6552 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 3.1507 0.3275 9.621 8.84e-16 *** ## school 0.1549 0.0511 3.032 0.00312 ** ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.746 on 97 degrees of freedom ## Multiple R-squared: 0.08656, Adjusted R-squared: 0.07714 ## F-statistic: 9.192 on 1 and 97 DF, p-value: 0.003118 ``` ] .pull-right[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ school + invest, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -3.8893 -1.3835 -0.2008 1.1318 4.6520 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 2.48804 0.42280 5.885 5.83e-08 *** ## school 0.05201 0.06584 0.790 0.4315 ## invest 0.06962 0.02906 2.396 0.0185 * ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.705 on 96 degrees of freedom ## Multiple R-squared: 0.1381, Adjusted R-squared: 0.1201 ## F-statistic: 7.69 on 2 and 96 DF, p-value: 0.0007988 ``` ] ] Studies often include *control variables*. ??? Common control variables used: gender, education, SES --- Why did secondary school enrolment alone have an effect but not when controlled for investment? <!-- --> ??? Actually, investments have the effect. --- An effect may only become apparent in combination with other predictors. .small[ .pull-left[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ literacy60, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -4.5792 -1.1606 -0.2863 1.3109 4.9720 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 3.636443 0.314204 11.574 <2e-16 *** ## literacy60 0.007127 0.005181 1.376 0.172 ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.809 on 97 degrees of freedom ## Multiple R-squared: 0.01913, Adjusted R-squared: 0.009021 ## F-statistic: 1.892 on 1 and 97 DF, p-value: 0.1721 ``` ] .pull-right[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ literacy60 + popgrowth, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -3.931 -1.011 -0.017 1.125 4.185 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 0.787982 0.645075 1.222 0.224875 ## literacy60 0.019467 0.005291 3.680 0.000386 *** ## popgrowth 1.004444 0.204523 4.911 3.71e-06 *** ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.626 on 96 degrees of freedom ## Multiple R-squared: 0.2161, Adjusted R-squared: 0.1998 ## F-statistic: 13.23 on 2 and 96 DF, p-value: 8.412e-06 ``` ] ] ??? Coefficients change, too. --- Why does literacy have no effect alone but does so with population growth? <!-- --> --- ### Model fit is improved .small[ .pull-left[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ popgrowth, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -4.6765 -1.1323 0.0118 1.0706 4.9706 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 2.5471 0.4602 5.535 2.65e-07 *** ## popgrowth 0.6470 0.1913 3.383 0.00104 ** ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.728 on 97 degrees of freedom ## Multiple R-squared: 0.1055, Adjusted R-squared: 0.09631 ## F-statistic: 11.44 on 1 and 97 DF, p-value: 0.001036 ``` ] .pull-right[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ ., data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -2.57012 -0.56269 -0.07555 0.57741 2.09275 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -1.339e-01 4.718e-01 -0.284 0.777195 ## oilTRUE 1.035e+00 6.992e-01 1.480 0.142380 ## interTRUE 1.029e+00 3.016e-01 3.411 0.000974 *** ## oecdTRUE -2.372e-01 4.774e-01 -0.497 0.620490 ## gdp60 -7.818e-04 7.706e-05 -10.146 < 2e-16 *** ## gdp85 4.550e-04 5.456e-05 8.340 8.70e-13 *** ## popgrowth 1.056e+00 1.682e-01 6.277 1.23e-08 *** ## invest 4.192e-02 1.870e-02 2.243 0.027413 * ## school 7.766e-02 5.500e-02 1.412 0.161425 ## literacy60 -3.822e-03 6.665e-03 -0.573 0.567837 ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 0.9636 on 89 degrees of freedom ## Multiple R-squared: 0.7448, Adjusted R-squared: 0.719 ## F-statistic: 28.85 on 9 and 89 DF, p-value: < 2.2e-16 ``` ] ] --- Why do multiple variables better explain variation? <!-- --> --- class: center middle inverse # Selection of predictors --- We can start with adding all other variables as predictors. ``` ## ## Call: ## lm(formula = gdpgrowth ~ ., data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -2.57012 -0.56269 -0.07555 0.57741 2.09275 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -1.339e-01 4.718e-01 -0.284 0.777195 ## oilTRUE 1.035e+00 6.992e-01 1.480 0.142380 ## interTRUE 1.029e+00 3.016e-01 3.411 0.000974 *** ## oecdTRUE -2.372e-01 4.774e-01 -0.497 0.620490 ## gdp60 -7.818e-04 7.706e-05 -10.146 < 2e-16 *** ## gdp85 4.550e-04 5.456e-05 8.340 8.70e-13 *** ## popgrowth 1.056e+00 1.682e-01 6.277 1.23e-08 *** ## invest 4.192e-02 1.870e-02 2.243 0.027413 * ## school 7.766e-02 5.500e-02 1.412 0.161425 ## literacy60 -3.822e-03 6.665e-03 -0.573 0.567837 ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 0.9636 on 89 degrees of freedom ## Multiple R-squared: 0.7448, Adjusted R-squared: 0.719 ## F-statistic: 28.85 on 9 and 89 DF, p-value: < 2.2e-16 ``` --- ## Statistical significance We could remove statistically insignificant variables. .small[ .pull-left[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ ., data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -2.57012 -0.56269 -0.07555 0.57741 2.09275 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -1.339e-01 4.718e-01 -0.284 0.777195 ## oilTRUE 1.035e+00 6.992e-01 1.480 0.142380 ## interTRUE 1.029e+00 3.016e-01 3.411 0.000974 *** ## oecdTRUE -2.372e-01 4.774e-01 -0.497 0.620490 ## gdp60 -7.818e-04 7.706e-05 -10.146 < 2e-16 *** ## gdp85 4.550e-04 5.456e-05 8.340 8.70e-13 *** ## popgrowth 1.056e+00 1.682e-01 6.277 1.23e-08 *** ## invest 4.192e-02 1.870e-02 2.243 0.027413 * ## school 7.766e-02 5.500e-02 1.412 0.161425 ## literacy60 -3.822e-03 6.665e-03 -0.573 0.567837 ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 0.9636 on 89 degrees of freedom ## Multiple R-squared: 0.7448, Adjusted R-squared: 0.719 ## F-statistic: 28.85 on 9 and 89 DF, p-value: < 2.2e-16 ``` ] .pull-right[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ inter + gdp60 + gdp85 + popgrowth + ## invest, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -2.67920 -0.55299 -0.07245 0.68938 2.25172 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -3.807e-01 4.312e-01 -0.883 0.379524 ## interTRUE 8.854e-01 2.483e-01 3.565 0.000576 *** ## gdp60 -7.761e-04 7.470e-05 -10.389 < 2e-16 *** ## gdp85 4.738e-04 4.949e-05 9.575 1.62e-15 *** ## popgrowth 1.227e+00 1.246e-01 9.852 4.21e-16 *** ## invest 4.546e-02 1.789e-02 2.540 0.012732 * ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 0.971 on 93 degrees of freedom ## Multiple R-squared: 0.7292, Adjusted R-squared: 0.7146 ## F-statistic: 50.08 on 5 and 93 DF, p-value: < 2.2e-16 ``` ] ] --- ## F-test This is a test of overall model fit. F-statistic is calculated as follows: `$$F = \frac{RSS_1 - RSS_1 / k}{RSS_2/(n-p-1)},$$` where `\(RSS_1\)` is the residual sum of squares of reduced model and `\(RSS_2\)` the same for full model, `\(k\)` the difference in the number of parameters between two models, `\(p\)` the number of parameters and `\(n\)` the number of observations. `\(H_0: \beta_1 = \beta_2 = 0\)` `\(H_1: \beta_1 \neq 0 \text{ or } \beta_2 \neq 0\)` --- Are oil producing and OECD membership together significant predictors of economic growth? ``` ## ## Call: ## lm(formula = gdpgrowth ~ oil + oecd, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -4.8676 -1.2179 -0.0682 1.1324 5.2324 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 3.96757 0.21140 18.768 <2e-16 *** ## oilTRUE 1.43243 1.07099 1.337 0.184 ## oecdTRUE -0.09939 0.44159 -0.225 0.822 ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.819 on 96 degrees of freedom ## Multiple R-squared: 0.01954, Adjusted R-squared: -0.0008835 ## F-statistic: 0.9567 on 2 and 96 DF, p-value: 0.3878 ``` -- > How would you interpret the p-value for F-statistic here? --- ## Akaike Information Criterion (AIC) It's a measure of model goodness of fit. For linear regression the information criterion is calculated as follows: `$$AIC = n \times log(\frac{RSS}{n}) + 2 K,$$` where `\(n\)` is the number of observations, `\(RSS\)` the residual sums of squares and `\(K\)` the number of predictors in a model. **Lower** value indicates better fit. --- Stepwise backwards selection according to AIC .scroll[ ``` ## Start: AIC=2.12 ## gdpgrowth ~ oil + inter + oecd + gdp60 + gdp85 + popgrowth + ## invest + school + literacy60 ## ## Df Sum of Sq RSS AIC ## - oecd 1 0.229 82.875 0.399 ## - literacy60 1 0.305 82.951 0.489 ## <none> 82.645 2.124 ## - school 1 1.851 84.497 2.318 ## - oil 1 2.034 84.680 2.532 ## - invest 1 4.670 87.315 5.566 ## - inter 1 10.807 93.453 12.291 ## - popgrowth 1 36.586 119.232 36.409 ## - gdp85 1 64.583 147.229 57.290 ## - gdp60 1 95.587 178.232 76.209 ## ## Step: AIC=0.4 ## gdpgrowth ~ oil + inter + gdp60 + gdp85 + popgrowth + invest + ## school + literacy60 ## ## Df Sum of Sq RSS AIC ## - literacy60 1 0.276 83.151 -1.272 ## <none> 82.875 0.399 ## - school 1 1.794 84.669 0.519 ## - oil 1 2.124 84.999 0.904 ## - invest 1 4.537 87.412 3.676 ## - inter 1 10.718 93.592 10.439 ## - popgrowth 1 59.014 141.889 51.632 ## - gdp85 1 69.725 152.600 58.837 ## - gdp60 1 96.615 179.490 74.905 ## ## Step: AIC=-1.27 ## gdpgrowth ~ oil + inter + gdp60 + gdp85 + popgrowth + invest + ## school ## ## Df Sum of Sq RSS AIC ## - school 1 1.557 84.708 -1.435 ## <none> 83.151 -1.272 ## - oil 1 2.776 85.927 -0.021 ## - invest 1 4.391 87.542 1.823 ## - inter 1 10.820 93.971 8.839 ## - popgrowth 1 63.770 146.921 53.083 ## - gdp85 1 69.577 152.728 56.920 ## - gdp60 1 104.954 188.105 77.546 ## ## Step: AIC=-1.43 ## gdpgrowth ~ oil + inter + gdp60 + gdp85 + popgrowth + invest ## ## Df Sum of Sq RSS AIC ## <none> 84.708 -1.435 ## - oil 1 2.977 87.685 -0.015 ## - invest 1 6.580 91.288 3.971 ## - inter 1 14.935 99.643 12.641 ## - popgrowth 1 65.310 150.019 53.148 ## - gdp85 1 77.856 162.564 61.099 ## - gdp60 1 103.411 188.119 75.554 ``` ``` ## ## Call: ## lm(formula = gdpgrowth ~ oil + inter + gdp60 + gdp85 + popgrowth + ## invest, data = GrowthDJ) ## ## Coefficients: ## (Intercept) oilTRUE interTRUE gdp60 gdp85 popgrowth ## -0.2703433 1.2002245 1.0822840 -0.0007836 0.0004574 1.1309585 ## invest ## 0.0473560 ``` ] --- ## Multicollinearity It should not be possible to linearly predict any of the predictors from others predictors. Predictors should not be (highly) correlated. -- Let's look at Pearson's correlation coefficients pairwise. ``` ## oil inter oecd gdp60 gdp85 gdpgrowth popgrowth invest school literacy60 ## oil 1.00 -0.30 -0.09 0.12 0.09 0.14 0.26 -0.04 0.01 -0.19 ## inter -0.30 1.00 0.31 0.34 0.39 0.32 -0.14 0.38 0.51 0.60 ## oecd -0.09 0.31 1.00 0.68 0.78 -0.04 -0.72 0.57 0.57 0.66 ## gdp60 0.12 0.34 0.68 1.00 0.88 -0.09 -0.40 0.52 0.66 0.73 ## gdp85 0.09 0.39 0.78 0.88 1.00 0.21 -0.50 0.68 0.74 0.78 ## gdpgrowth 0.14 0.32 -0.04 -0.09 0.21 1.00 0.32 0.36 0.29 0.14 ## popgrowth 0.26 -0.14 -0.72 -0.40 -0.50 0.32 1.00 -0.35 -0.31 -0.47 ## invest -0.04 0.38 0.57 0.52 0.68 0.36 -0.35 1.00 0.65 0.64 ## school 0.01 0.51 0.57 0.66 0.74 0.29 -0.31 0.65 1.00 0.82 ## literacy60 -0.19 0.60 0.66 0.73 0.78 0.14 -0.47 0.64 0.82 1.00 ``` > Can you see anything that could result in collinearity? ??? Otherwise the coefficients are not be reliable. --- ### Variance inflation factor (VIF) Multicollinearity can be detected with variance inflation factor by using `\(R^2\)` to estimate for each predictor how much of the variation in one predictor can be predicted from others. `$$VIF_{k} = \frac{1}{1 - R^{2}_{k-1}},$$` where `\(R^{2}_{k-1}\)` is `\(R^{2}\)` for a model that has predictor `\(k\)` as a response variable and all other predictors as predictor variables. Remove predictors that have VIF >5. --- What about our predictors that were selected using backwards selection with AIC? ```r Model <- lm(gdpgrowth ~ oil + inter + gdp60 + gdp85 + popgrowth + invest, GrowthDJ) car::vif(Model) ``` ``` ## oil inter gdp60 gdp85 popgrowth invest ## 1.407719 1.465608 4.790481 7.335392 1.598502 2.042422 ``` > Would you exclude anything? -- ```r Model <- update(Model, ~ oil + inter + gdp60 + popgrowth + invest) car::vif(Model) ``` ``` ## oil inter gdp60 popgrowth invest ## 1.360429 1.427928 1.735117 1.422307 1.512411 ``` --- What happens when we exclude influential predictors? .small[ .pull-left[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ oil + inter + gdp60 + gdp85 + popgrowth + ## invest, data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -2.71855 -0.53884 -0.03123 0.61961 2.39368 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -2.703e-01 4.305e-01 -0.628 0.531552 ## oilTRUE 1.200e+00 6.675e-01 1.798 0.075441 . ## interTRUE 1.082e+00 2.687e-01 4.027 0.000116 *** ## gdp60 -7.836e-04 7.394e-05 -10.598 < 2e-16 *** ## gdp85 4.574e-04 4.975e-05 9.195 1.13e-14 *** ## popgrowth 1.131e+00 1.343e-01 8.422 4.74e-13 *** ## invest 4.736e-02 1.771e-02 2.673 0.008888 ** ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 0.9596 on 92 degrees of freedom ## Multiple R-squared: 0.7384, Adjusted R-squared: 0.7213 ## F-statistic: 43.28 on 6 and 92 DF, p-value: < 2.2e-16 ``` ] .pull-right[ ``` ## ## Call: ## lm(formula = gdpgrowth ~ oil + inter + gdp60 + popgrowth + invest, ## data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -4.7848 -0.8059 -0.0678 0.9298 3.7399 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -3.328e-01 5.931e-01 -0.561 0.576036 ## oilTRUE 2.325e+00 9.041e-01 2.572 0.011703 * ## interTRUE 1.478e+00 3.655e-01 4.045 0.000108 *** ## gdp60 -2.406e-04 6.131e-05 -3.924 0.000167 *** ## popgrowth 7.210e-01 1.745e-01 4.131 7.88e-05 *** ## invest 1.303e-01 2.100e-02 6.205 1.50e-08 *** ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.322 on 93 degrees of freedom ## Multiple R-squared: 0.4979, Adjusted R-squared: 0.471 ## F-statistic: 18.45 on 5 and 93 DF, p-value: 1.095e-12 ``` ] ] --- Our final model. ``` ## ## Call: ## lm(formula = gdpgrowth ~ oil + inter + gdp60 + popgrowth + invest, ## data = GrowthDJ) ## ## Residuals: ## Min 1Q Median 3Q Max ## -4.7848 -0.8059 -0.0678 0.9298 3.7399 ## ## Coefficients: ## Estimate Std. Error t value Pr(>|t|) ## (Intercept) -3.328e-01 5.931e-01 -0.561 0.576036 ## oilTRUE 2.325e+00 9.041e-01 2.572 0.011703 * ## interTRUE 1.478e+00 3.655e-01 4.045 0.000108 *** ## gdp60 -2.406e-04 6.131e-05 -3.924 0.000167 *** ## popgrowth 7.210e-01 1.745e-01 4.131 7.88e-05 *** ## invest 1.303e-01 2.100e-02 6.205 1.50e-08 *** ## --- ## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 ## ## Residual standard error: 1.322 on 93 degrees of freedom ## Multiple R-squared: 0.4979, Adjusted R-squared: 0.471 ## F-statistic: 18.45 on 5 and 93 DF, p-value: 1.095e-12 ``` > How to interpret this? --- class: center middle inverse # Presenting the results --- .compact[ <table style="text-align:center"><tr><td colspan="6" style="border-bottom: 1px solid black"></td></tr><tr><td style="text-align:left"></td><td colspan="5"><em>Dependent variable:</em></td></tr> <tr><td></td><td colspan="5" style="border-bottom: 1px solid black"></td></tr> <tr><td style="text-align:left"></td><td colspan="5">gdpgrowth</td></tr> <tr><td style="text-align:left"></td><td>(1)</td><td>(2)</td><td>(3)</td><td>(4)</td><td>(5)</td></tr> <tr><td colspan="6" style="border-bottom: 1px solid black"></td></tr><tr><td style="text-align:left">oil</td><td></td><td></td><td></td><td>1.035</td><td>1.200<sup>*</sup></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td>(0.699)</td><td>(0.667)</td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">inter</td><td></td><td></td><td></td><td>1.029<sup>***</sup></td><td>1.082<sup>***</sup></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td>(0.302)</td><td>(0.269)</td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">oecd</td><td></td><td></td><td></td><td>-0.237</td><td></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td>(0.477)</td><td></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">gdp60</td><td></td><td></td><td></td><td>-0.001<sup>***</sup></td><td>-0.001<sup>***</sup></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td>(0.0001)</td><td>(0.0001)</td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">gdp85</td><td></td><td></td><td></td><td>0.0005<sup>***</sup></td><td>0.0005<sup>***</sup></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td>(0.0001)</td><td>(0.00005)</td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">literacy60</td><td></td><td></td><td>0.019<sup>***</sup></td><td>-0.004</td><td></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td>(0.005)</td><td>(0.007)</td><td></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">popgrowth</td><td>1.025<sup>***</sup></td><td></td><td>1.004<sup>***</sup></td><td>1.056<sup>***</sup></td><td>1.131<sup>***</sup></td></tr> <tr><td style="text-align:left"></td><td>(0.173)</td><td></td><td>(0.205)</td><td>(0.168)</td><td>(0.134)</td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">school</td><td></td><td>0.052</td><td></td><td>0.078</td><td></td></tr> <tr><td style="text-align:left"></td><td></td><td>(0.066)</td><td></td><td>(0.055)</td><td></td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">invest</td><td>0.126<sup>***</sup></td><td>0.070<sup>**</sup></td><td></td><td>0.042<sup>**</sup></td><td>0.047<sup>***</sup></td></tr> <tr><td style="text-align:left"></td><td>(0.020)</td><td>(0.029)</td><td></td><td>(0.019)</td><td>(0.018)</td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td style="text-align:left">Constant</td><td>-0.507</td><td>2.488<sup>***</sup></td><td>0.788</td><td>-0.134</td><td>-0.270</td></tr> <tr><td style="text-align:left"></td><td>(0.624)</td><td>(0.423)</td><td>(0.645)</td><td>(0.472)</td><td>(0.430)</td></tr> <tr><td style="text-align:left"></td><td></td><td></td><td></td><td></td><td></td></tr> <tr><td colspan="6" style="border-bottom: 1px solid black"></td></tr><tr><td style="text-align:left">Observations</td><td>99</td><td>99</td><td>99</td><td>99</td><td>99</td></tr> <tr><td style="text-align:left">R<sup>2</sup></td><td>0.365</td><td>0.138</td><td>0.216</td><td>0.745</td><td>0.738</td></tr> <tr><td style="text-align:left">Adjusted R<sup>2</sup></td><td>0.352</td><td>0.120</td><td>0.200</td><td>0.719</td><td>0.721</td></tr> <tr><td style="text-align:left">Residual Std. Error</td><td>1.464 (df = 96)</td><td>1.705 (df = 96)</td><td>1.626 (df = 96)</td><td>0.964 (df = 89)</td><td>0.960 (df = 92)</td></tr> <tr><td style="text-align:left">F Statistic</td><td>27.586<sup>***</sup> (df = 2; 96)</td><td>7.690<sup>***</sup> (df = 2; 96)</td><td>13.231<sup>***</sup> (df = 2; 96)</td><td>28.855<sup>***</sup> (df = 9; 89)</td><td>43.278<sup>***</sup> (df = 6; 92)</td></tr> <tr><td colspan="6" style="border-bottom: 1px solid black"></td></tr><tr><td style="text-align:left"><em>Note:</em></td><td colspan="5" style="text-align:right"><sup>*</sup>p<0.1; <sup>**</sup>p<0.05; <sup>***</sup>p<0.01</td></tr> </table> ] --- class: center middle inverse # Practical application --- Use the data set `TeachingRatings`. Investigate the effects on the course overall teaching evaluation score (`eval`). > What are the effects? > Which variables should we use as predictors? -- > Does our final model meet the assumptions of a least squares model? --- class: inverse